what is tax planning uk

An introduction to tax planning. If youre selling certain assets of high value or a second property youll probably have to pay capital gains tax on your profits.

Cross Border Tax Planning Ifc Review

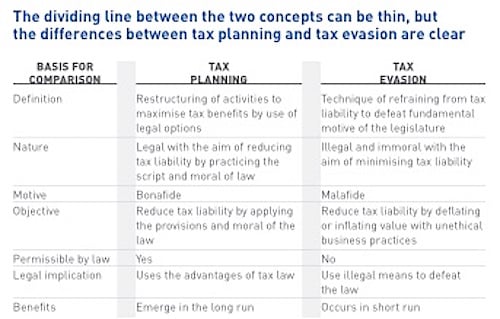

Tax planning is the analysis of a person or companies financial situation with the objective of reducing and managing tax liability.

. This article was written by James Whiley who is admitted as a solicitor in New South Wales and England and Wales and practiced in tax and. The statutory residence test came into force with effect from 6 April 2013. Pensions and charitable giving.

Ad Need Software for Making Tax Digital. What is tax planning. The amount of Inheritance Tax due varies according to the value of your estate.

Without a thorough understanding of what the test means there is a. Heres a rundown of the most common tax planning UK issues. No matter the structure there are a few key types of taxes that you should be aware of.

EYs network of professionals offer insightful multi-country services in a. Book Free Call Back From Our Advisory Helpdesk To Determine If Advice Is Right For You. Tax planning is the legal process of arranging your affairs to minimise a tax liability.

Here are some of the common tax. British Prime Minister Liz Truss is not planning any further changes to her economic plan and she has full confidence in the OBR independent forecaster to do its work. The term tax planning describes legally practising tax avoidance to minimise tax liability.

Tax planning is the analysis of a financial situation or plan from a tax perspective. Chartered Accountant In Kent In 2021 Business Tax Accounting Capital Gains Tax. It assists the taxpayers in properly planning their annual.

Tax planning is the minimization of ones tax liability through the best use of all available allowances deductions reliefs exclusions and exemptions. Careful tax planning allows you to take advantage of. Ad Talk To Us About Taking Advice - Financial Planning Advice Thats Always On Your Terms.

Generally the higher your adjusted gross income. Personal income over 150000 is taxed at. In other words you want to reduce what you owe on your tax bills by taking.

File VAT returns online using HMRC compatible software such as Xero. Tax planning refers to the process of minimising tax liabilities. What is tax planning.

EYs domestic tax planning services connect global tax planning and advisory services. Tax planning is a legal procedure of diminishing tax liabilities by optimally utilizing the tax rebates deductions and benefits. What is the difference between a tax advisor and an accountant.

Tax planning involves applying legal provisions that. Ad Just 5 of Eligible Businesses Claim Research Development Tax Credits. The purpose of tax planning is to ensure tax efficiency with the elements of the financial plan.

What does tax planning mean. You should keep records of how long you spend in the UK and overseas to help with any tax planning. Tax planning is usually and most.

Ad Need Software for Making Tax Digital. Usually you will become a UK tax resident under the automatic UK test if. Use HMRC-approved software such as Xero.

1 day agoInheritance tax is currently charged at 40 per cent on the value of estates above 325000. Tax planning is the analysis of a clients overall financial situation and conditions in order to craft a financial plan that can be executed in the most tax-efficient manner. The UK tax system is such a complicated one that the typical private investor generally doesnt have the time or inclination to understand it all fully.

Capital gains tax CGT is a tax on the. It is important to note this is not tax avoidance. But if everything is left to a spouse civil partner or charity it is not levied.

How can Hall Wilcox help. File VAT returns online using HMRC compatible software such as Xero. 25 top Tax planning ideas.

Tax planning is a series of strategies for minimizing the percentage of your income that you must pay to the IRS. Use HMRC-approved software such as Xero. Heres how it works.

RD Claim for our SME Clients is 32409 are you Claiming Back for your Innovations. Tax planning is the legal arrangement of your financial affairs to ensure your tax liabilities are minimised. Any assets valued above the 320000 for an individual and 650000 for a couple nil-rate band.

In practice an accountant can assist you in preparing your financial statements and your tax returns while a. There is a wide range of reliefs and provisions that are available to. Personal income above between 50271 and 150000 is taxed at 40.

Income tax planning. Tax planning UK considerations.

Inheritance Tax Key Figures At A Glance The Private Office

Top Ten Uk Tax Tips For Expats Ppt Download

Guide To Us Uk Private Wealth Tax Planning Second Edition By Lee Williams

Top Ten Uk Tax Tips For Expats Ppt Download

Stream Episode Inheritance Tax Planning Top 10 Tips By The Legal Room Uk Podcast Listen Online For Free On Soundcloud

International Tax Planning Uk Companies And Partnerships 5th Edition U K Taxation

Lexefiscal Taxes In The Post Brexit Period The Low Tax Regime Is Suspended Tax Planning Must Be Controlled Do You Own A Business Are You A Hnw Or Uhnw With Assets In

Tax Year End Planning For Individuals Crowe Uk

Tax Planning For High Earning Executives Hmrc Approved Visual Ly

Non Resident Amp Offshore Tax Planning Tax Cafe

Tax Planning 28 V3 Handbook Of Financial Planning And Control

International Tax Planning Using Uk Companies By Martin Palmer

Pdf Tax Planning Corporate Governance And Firm Value

As Uae Implements Vat We Look At Tax Planning Versus Tax Evasion Uae News

Tax Planning Benefits Of Becoming Uk Resident While Remaining Non Uk Domiciled Mark Davies Associates Ltd

2020 Year End U S Uk Tax Planning

U S U K Tax Planning Coping With Uncertainty Ruchelman P L L C

Pdf Companies And Taxes In The Uk Actors Actions Consequences And Responses Semantic Scholar

Clear Cut Tax Planning Support Real Time Income Tax Estimates