vermont department of taxes myvtax

You can also email myVTax support or call us at 802-828-6802 or 802-828-2551. The Los Angeles County Department of Workforce Development Aging and Community Services WDACS launched the LA County Employer Assistance Grant Fund on April 9 offering grants of up to 10000 to small businesses with 2-50 employees and less than 2 million in gross receipts on a first-come first-served basis.

The property tax credit is your payment on the 20212022 property taxes and needs to be considered at the closing when pro-rating the property taxes.

. 1099 State Filing Requirements - Tax1099 updates state by state listing of what 1099 MISC state reporting information you need to e-File with IRS. Our tax examiners are available to answer your questions about myVTax Monday through Friday from 745 am. You may now close this window.

Read the 2022 report. Read the 2022 legislative highlights to find out whats changed. NEW CONSTRUCTION New Construction New homestead construction where the property was built after April 1 2021 and is owned and occupied as a principal residence on April 1 2022 file Form HS-122.

The Vermont Department of Taxes publishes a report after each legislative session that outlines how legislation impacts taxpayers. Approximately 25 percent of. You have been successfully logged out.

Vermont Department Of Taxes Facebook

Rp 1231 Vermont Department Of Taxes Organizational Chart Department Of Taxes

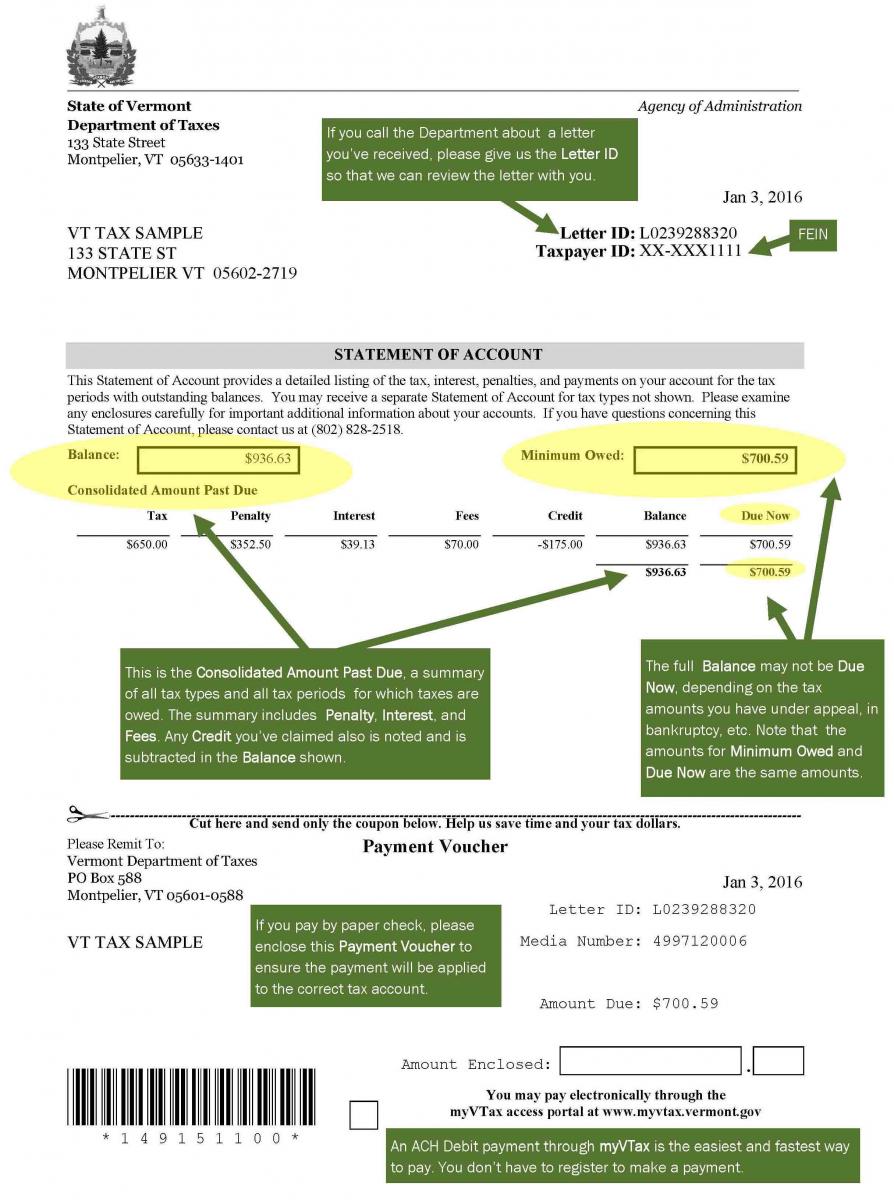

Your Tax Bill Department Of Taxes

Vermont Sales Tax Small Business Guide Truic

Vermont Department Of Taxes Facebook

Vermont Department Of Taxes Facebook

Vermont Department Of Taxes Youtube

Publications Department Of Taxes

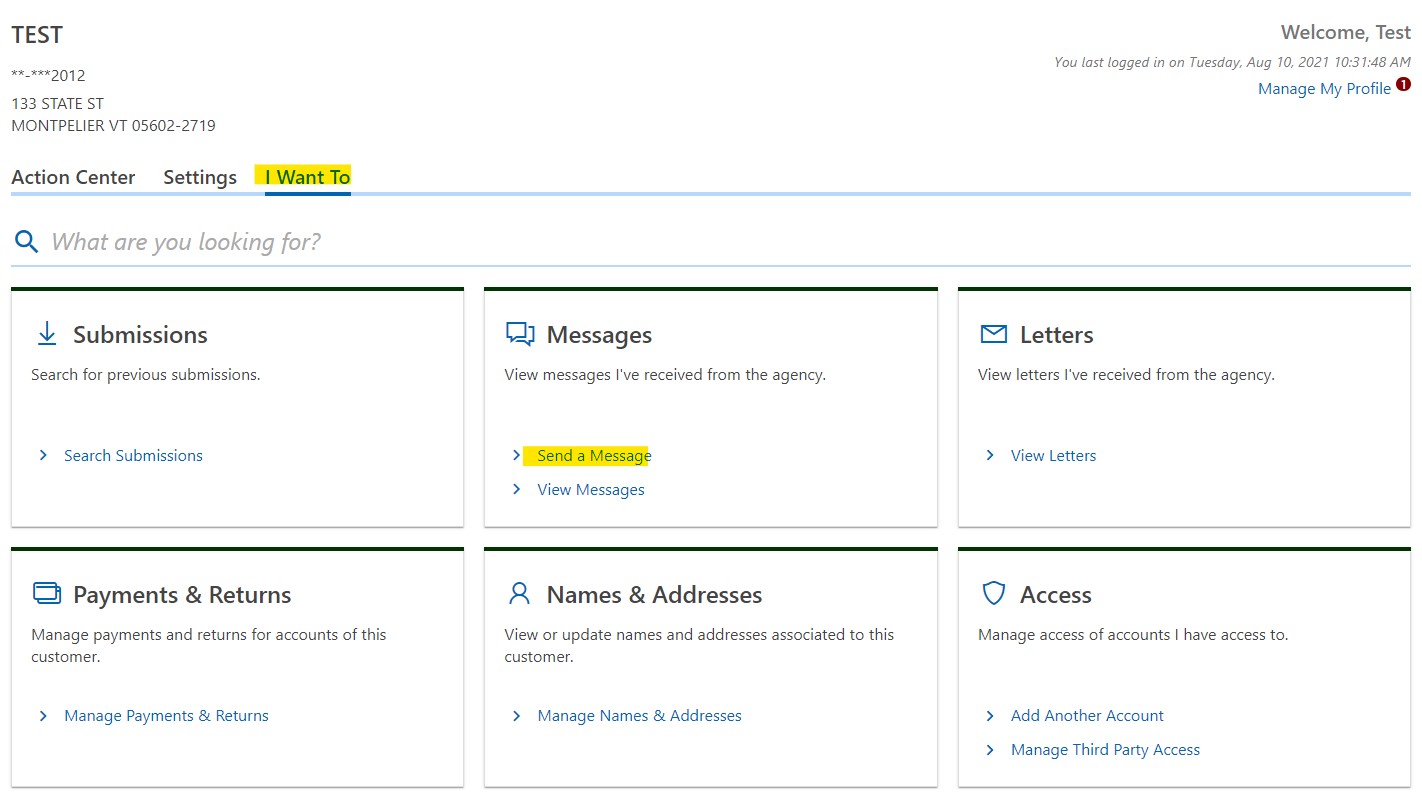

How To Send A Secure Message Department Of Taxes